Fuel your enterprise growth with Salesflo’s groundbreaking Sales & Distribution software enabling you to manage workflows, generate live insights, and increase sales efficiency with our unparalleled field force performance enhancement ecosystem.

Salesflo continues to provide best-in-class solutions in order to help our clients thrive

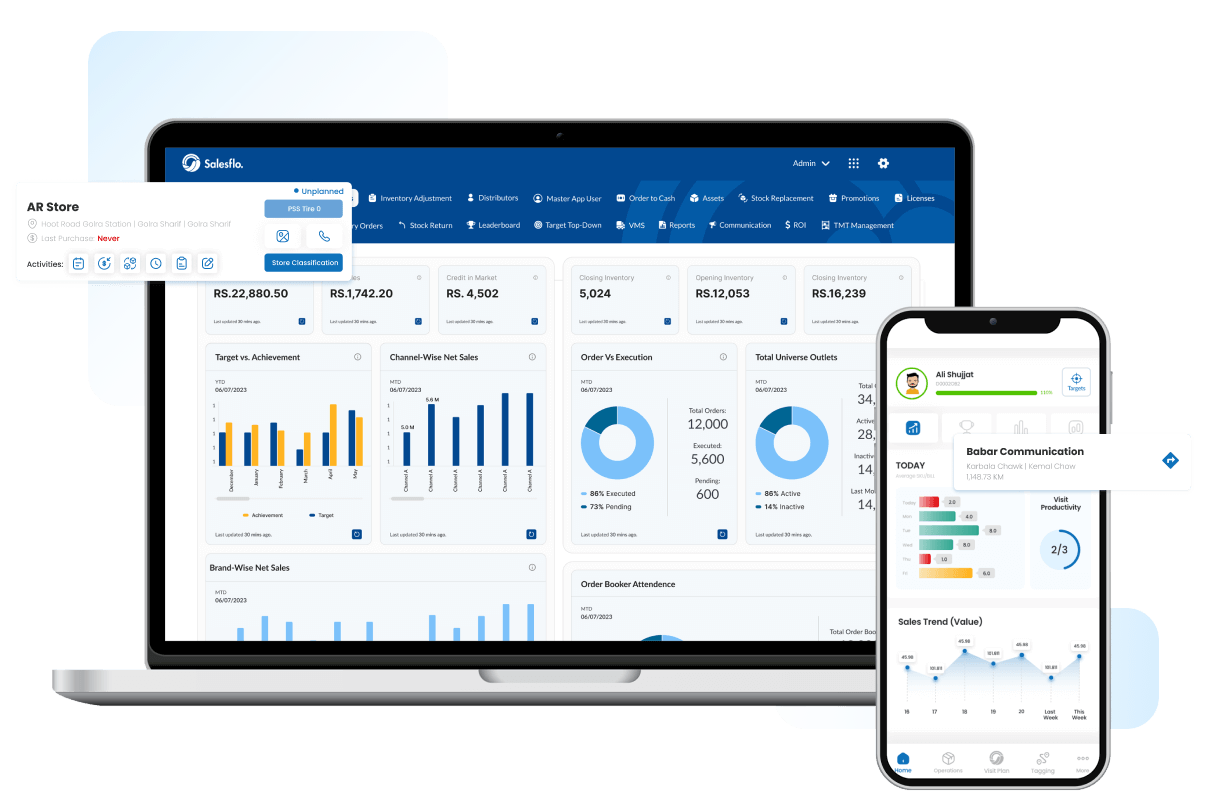

An award-winning end-to-end Sales and Distribution management system that helps fuel your business growth and boost Salesforce efficiency by automating the entire Business Value Chain.

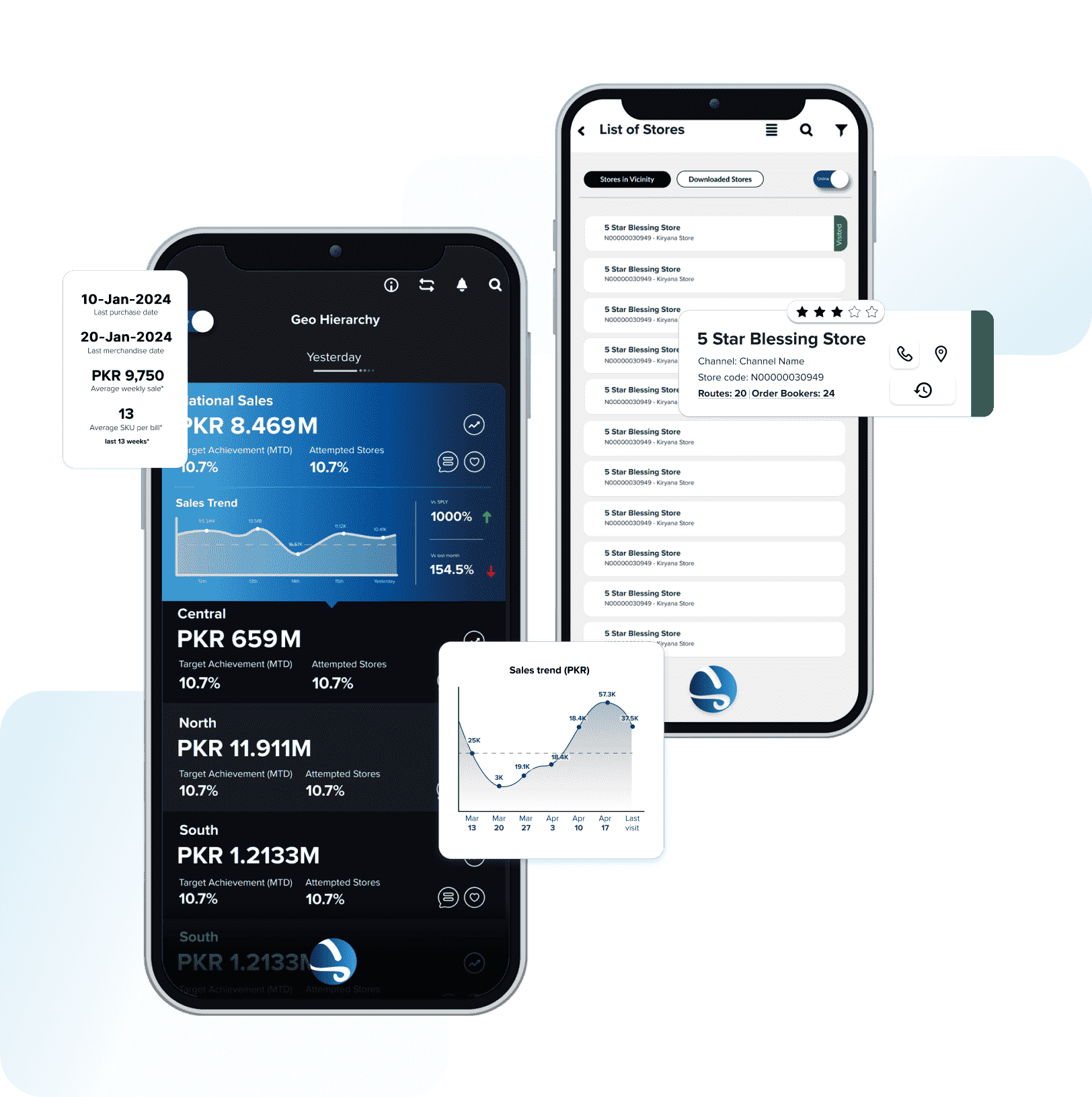

Business Intelligence Mobile Application that helps you condense rich data into actionable insights to make informed decisions.

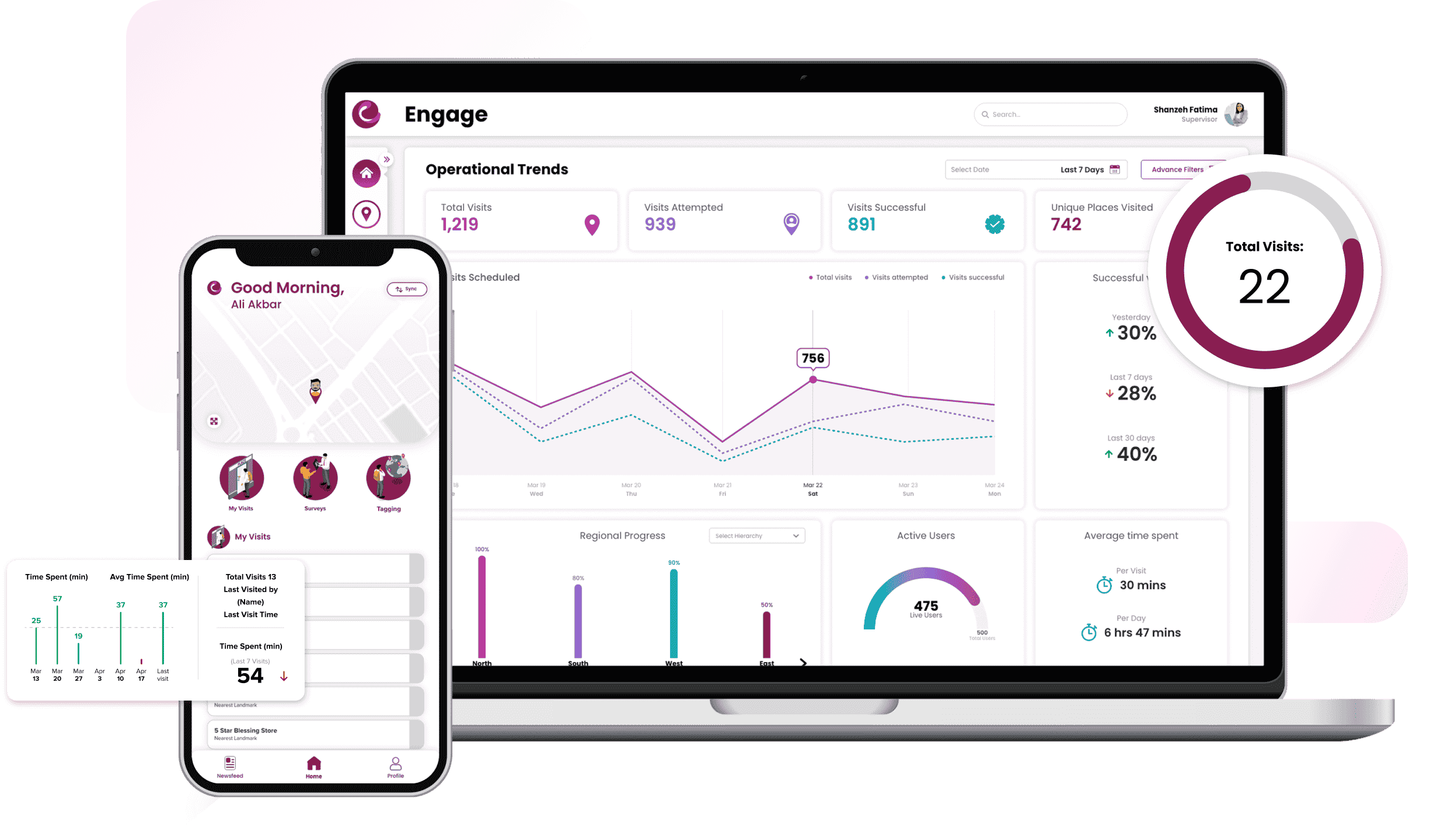

Automate business processes/workflows management to track your field operations and collect data to derive actionable insights with our best-in-class Workflow Management Tool.

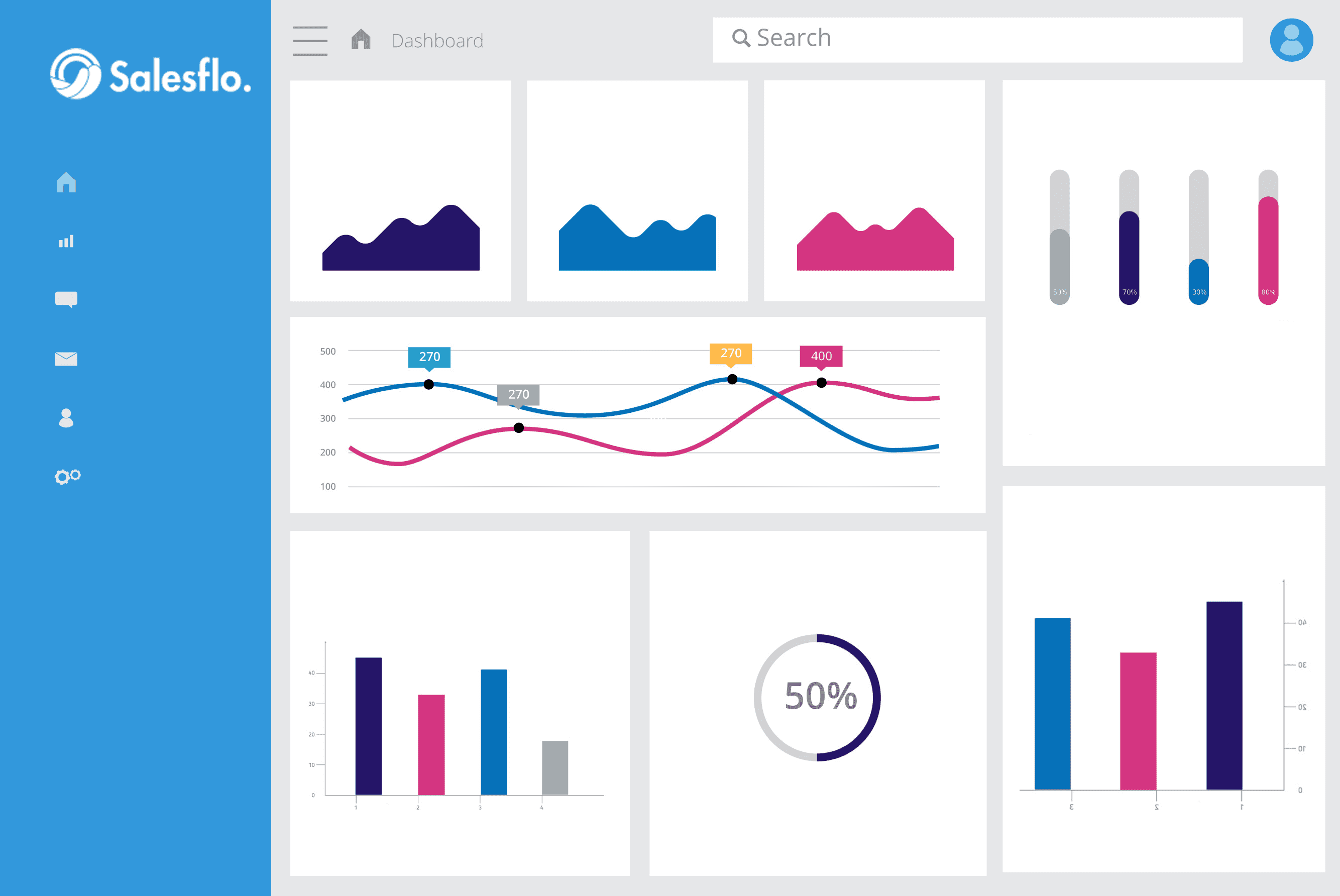

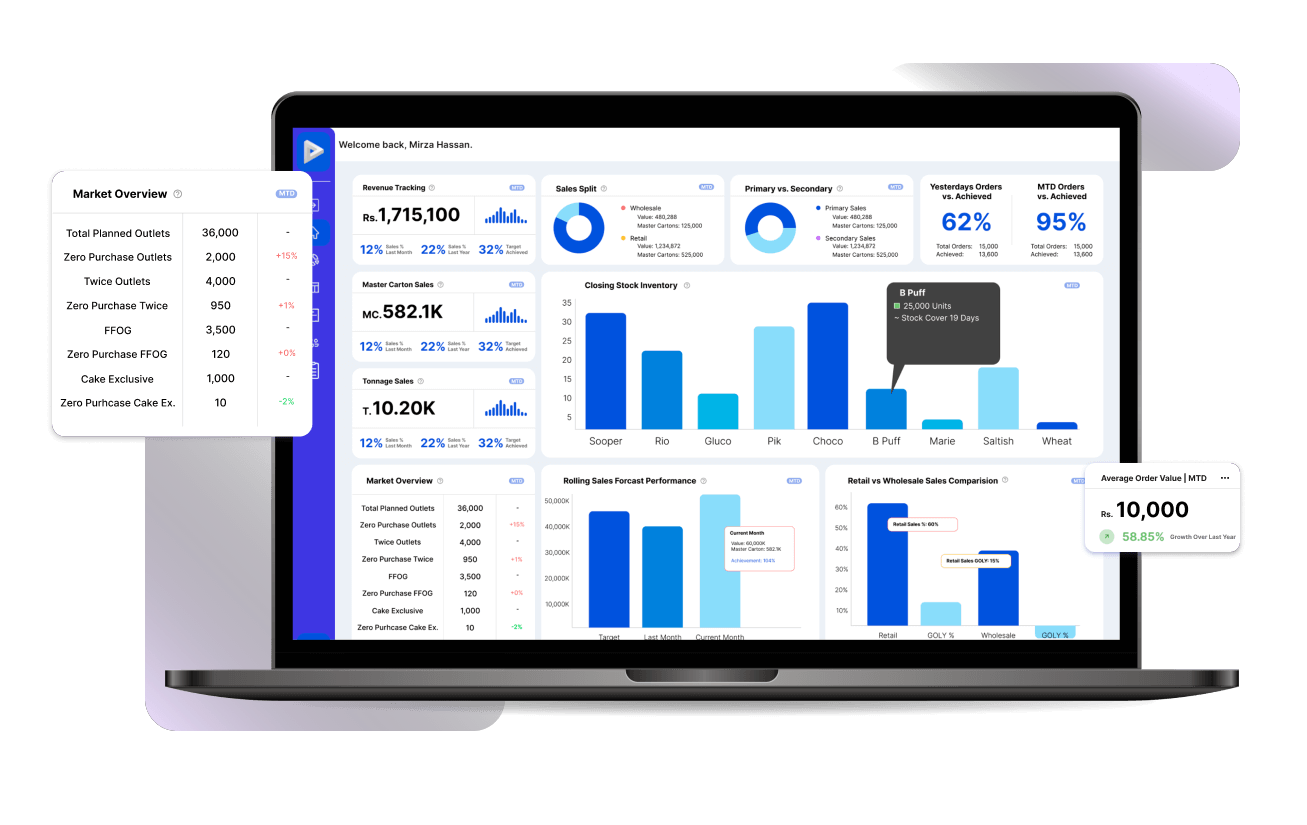

Salesflo Pulse is a dynamic web-driven Business Intelligence solution, reporting and analytics tool facilitating the seamless integration, in-depth analysis, engaging visualization, and effortless sharing of vital data.

Automate value chain and drive salesforce effectiveness by fueling business growth with an end-to-end Distribution Management System.

Business intelligence tools that help you develop data-driven strategies with customizable reports and dashboards to keep a track of business KPIs.

Automate business processes/workflows to track your field operations and collect data to derive actionable insights with our Workflow Management Tool.

Create customized reports, generate insightful dashboards and unlock the power of data on demand, with real-time insights to drive impactful decisions with our next generation reporting and analytics tool.